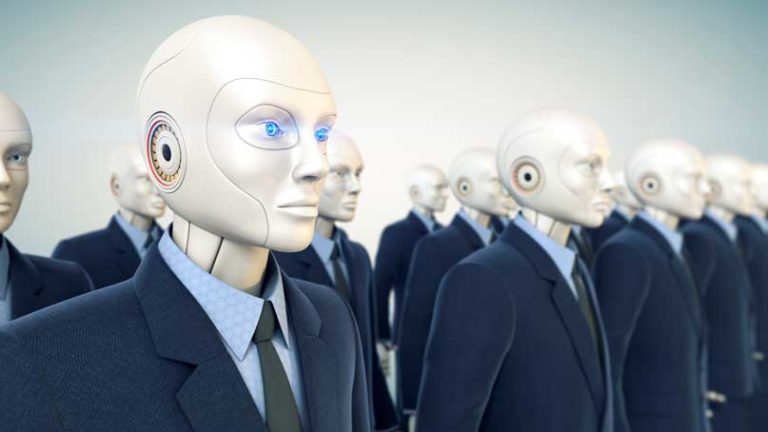

An important concept that makes achieving financial independence even more urgent is artificial intelligence. The keyword here is urgent….many times we procrastinate the notion of saving money because we think we have many years to build up our mountain of assets

– from Overcoming AI by Scott Gamm

But you might have fewer earning years than you think, so that quote sums up the thesis of Scott Gamm’s upcoming book, Overcome AI: How to Build a Secure Financial Future in the Age of Artificial Intelligence. (I think the subtitle of the book should actually have been the catchy title of Chapter 3: The Robots Determine How Much You Need To Retire!)

As a side note, this AI wave is REAL. In October, White Castle will pilot test a robot named Flippy, an “autonomous kitchen assistant”, who can fulfill different cooking tasks, including grilling and frying!

Gamm is a longtime financial journalist who has written for Yahoo! Finance and TheStreet. The book has actually very little information about AI and its impact on the economy or even investing.

The book is more an overview of how to achieve financial independence, with the AI piece just lending another good reason to do so.

That job you hate may not even be around in 5 years, 10 years or 15 years, thanks to robots….Herein lies the linkage between financial independence and artificial intelligence.

– from Overcoming AI by Scott Gamm

That said, Gamm’s journalism chops show through, and this book is an accessible read for someone who still needs convincing that saving a lot of money is a good idea.

Gamm outlines the typical ways to do so – target a high savings rate, track your expenses big and small, max out tax-advantaged retirement plans, focus on dividend stocks and/or low-cost diversified index funds, consider rental real estate.

Here are five of my favorite takeaways:

A lot of the financial rules you have been taught may not serve you so well for the next few decades

– from Overcoming AI by Scott Gamm

While Gamm was specifically talking about the “get a job-retire at 65” rule, I like this statement as a reminder not to manage your money on autopilot.

Some of the beliefs you hold so dear are things you need to let go (a lesson I’m still learning about buy-and-hold investing and a recent 33% avoidable loss).

The only thing certain about a 9-to-5 job is the amount of your paycheck. Your salary remains the same, with the exception of occasional raises, bonuses, or commissions….What isn’t stable about the 9-to-5 job is that the employer can lay you off at any time.

– from Overcoming AI by Scott Gamm

Another good reminder not to get complacent – this time about assuming job security. The paycheck may be steady, but employment tenure is not.

Whatever business or profession you are entering, build capabilities to be an entrepreneur….You have to know how to be nimble, and you have to invest in design thinking

– from Overcoming AI by Scott Gamm

I like that Gamm is not saying you have to be an entrepreneur – only that you need to entrepreneurial.

I agree that the workplace is increasingly demanding the skills and qualities of an entrepreneur, including strong branding, a supportive network, self-sufficiency, hustle and bottom line impact.

Take the artificial intelligence tax out of what is left after your actual taxes and deductions and use that remaining amount as what you’ll live off of in order to pay for your basic necessities and (some) entertainment

– from Overcoming AI by Scott Gamm

This was one of the more original ideas linking the AI and FI topics – savings as an AI tax!

Some people call it “paying yourself first”, but I like Gamm’s notion of considering it an “AI tax” that gets put away to build your assets towards FI, and a universal basic income that you fund (in case the government doesn’t get around to it).

I don’t know that it will inspire or scare people into saving more, but I thought it was an original way to look at it.

In terms of overall numbers of new jobs [from AI] the outlook is positive, with 133 million new jobs expected to be created by 2022 compared to 75 million that will be displaced….But what does it mean for individuals? If you’re one of the 75 million workers who will be displaced, will you be eligible for one of the 132 million jobs that will be created?

– from Overcoming AI by Scott Gamm

Like most of Gamm’s book, the quote references AI but is more about financial advice — in this case, career advice.

As a career coach, I agree wholeheartedly that looking at general market statistics makes no sense for the individual. You may not get one of the 132 million new jobs (and that’s just an estimate).

You are never the market unemployment rate – your unemployment rate is either 0 or 100%!

What’s on your reading list?

While I found Gamm’s book too basic for our situation, it’s a solid pick for readers starting to think about personal finance.

If you’re moved by the AI/ automation/ robotics trend, then his argument that financial independence is a hedge against the negative potential of AI may light the fire that pushes you to FIRE.

For a more advanced reader, I would recommend Beyond The Basics by Sammy Azzouz, which I reviewed earlier. My favorite financial writer is still Financial Mentor for his ultimate retirement calculator, and my favorite book of his is How Much Money Do I Need To Retire.

How about you? What’s on your reading list?

We are Scott and Caroline, 50-somethings who spent the first 20+ years of our adult lives in New York City, working traditional careers and raising 2 kids. We left full-time work in our mid-40’s for location-independent, part-time consulting projects and real estate investing, in order to create a more flexible and travel-centric lifestyle.

We are Scott and Caroline, 50-somethings who spent the first 20+ years of our adult lives in New York City, working traditional careers and raising 2 kids. We left full-time work in our mid-40’s for location-independent, part-time consulting projects and real estate investing, in order to create a more flexible and travel-centric lifestyle.  Financial independence and early retirement is not something we originally focused on, but over time realized it was possible. Our free report,

Financial independence and early retirement is not something we originally focused on, but over time realized it was possible. Our free report,