Living in New York City, the financial capital of the world, talk of the markets can easily occur multiple times a day even for the average bystander. I also happen to be a personal finance junkie, used to work in finance and still have friends in the field, so recession watch is at the top of my mind.

The recent inversion of the yield curve, where the yield on the 10-year Treasury note fell below the yield on the 3-month T-bill, has further stoked recession fears.

This Yahoo! Finance post predicts a stock market decline, though another post on the very same site recommends not worrying about a recession. Financial Samurai predicts recession by 2020. Daniel Amerman, one of my favorite real estate resources given his in-depth look at markets, sees positive and negative. Amerman thinks the average investor will get squeezed, but still sees upside in turning a 0% interest rate into a 21% yield.

A US Recession Negatively Impacts Our Real Estate In Several Ways

We are not market-timers and plan to leave our paper assets untouched for the long term. However, the majority of our assets are in real estate, and a recession could negatively impact our portfolio in several ways:

- If unemployment ticks up, tenants have more difficulty paying their rents. Evictions are expensive and time-consuming. But even without the worst-cast eviction scenario, there is still the danger of rents flattening or decreasing as maintenance costs and property taxes go up.

- If banks are unwilling to lend, there are fewer eligible buyers. If buyers do pass the banks’ tightening lending standards, they’ll be even choosier and looking for bargains. This impacts us if we decide to sell anything, and we are considering selling one of our Florida investment properties.

- If recession fears (real or imagined) dampen discretionary spending, travel spending could decrease. This would hurt our Costa Rica real estate since all our properties there are vacation rentals.

However, A US Recession Could Give Our Costa Rica Real Estate A Boost

If you tire of recession watch, a trip to Costa Rica could be the perfect antidote. High season is Christmas through Easter, so room rates will soften after that. The time after Easter is not the low season, which is September thru November, it is considered mid-season. Flights can be expensive, especially when summer hits and families vacation during the school break, but once you arrive, the other costs – lodging, food, attractions — are manageable.

If recession leads to unemployment and the freedom to do something new, Costa Rica is still a bargain destination for relocation. Our Tamarindo condos are a few blocks from the beach, the main strip for restaurants and shops, and the main commercial plaza that houses the Saturday farmers’ market and even a co-working space. Our house in Langosta already works well for large groups, so good become a co-living/ co-working space.

Our intention is to keep our properties as short-term rentals, but we could easily switch to long-term rentals, which would mean lower rents but much lower turnover and maintenance costs.

If recession forces an early retirement, Costa Rica is a top place to retire according to International Living, Money and Forbes. With its stable democracy, quality health care, and biodiversity, Costa Rica may get a boost if a recession causes people to prioritize quality of life at a reasonable cost.

As people come down to check out retirement living in Costa Rica, they’ll need a short-term place to stay. Our properties could become a mid-term rental for us, with rates in-between vacation rental and long-term contracts.

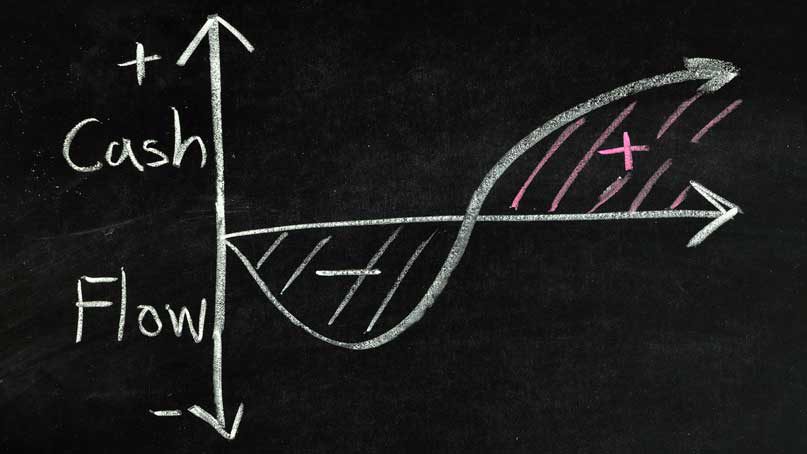

For our real estate in Costa Rica or the US, the monthly cash flow that rental real estate offers could become even more valuable to people turned off by the volatility of paper assets during a recession.

Real Estate Holds Its Value In A Recession If You Can Hold Onto It

The biggest risk to real estate investors in a recession is if you need to sell or refinance. Real estate is already much less liquid than paper assets because of the long lead times to transfer ownership and high transaction costs. In a recession, you might not be able to sell at all. If you have short-term financing, you may not be able to refinance in time, as banks tighten their lending standards, or you become a less desirable applicant if you lose your job or your business suffers.

Because it is difficult to get financing for real estate in Costa Rica, we did not finance any of our properties, so our monthly costs are low. There is no risk that we will miss a mortgage payment and have the properties repossessed. There is no risk that short-term financing will expire or a variable rate will increase beyond our means. We can hold through the recession that everyone seems to think is imminent (me, too, but I’ve been bearish for years now, so really I have no clue).

Therefore, a US recession may impact our real estate in Costa Rica, but we have options, if we need to adjust. We can change our rental strategy. We can offer seller financing if we really want to sell. We can move there ourselves and dramatically lower our living costs (I’ve been lobbying for this option for a while now, even before the recession talk became dire😊).

We bought real estate in Costa Rica specifically to provide some diversification, and now I’m especially glad we did.

We are Scott and Caroline, 50-somethings who spent the first 20+ years of our adult lives in New York City, working traditional careers and raising 2 kids. We left full-time work in our mid-40’s for location-independent, part-time consulting projects and real estate investing, in order to create a more flexible and travel-centric lifestyle.

We are Scott and Caroline, 50-somethings who spent the first 20+ years of our adult lives in New York City, working traditional careers and raising 2 kids. We left full-time work in our mid-40’s for location-independent, part-time consulting projects and real estate investing, in order to create a more flexible and travel-centric lifestyle.  Financial independence and early retirement is not something we originally focused on, but over time realized it was possible. Our free report,

Financial independence and early retirement is not something we originally focused on, but over time realized it was possible. Our free report,