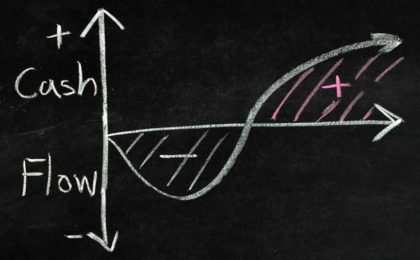

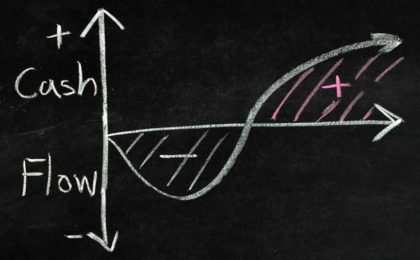

There is a long-running debate about whether to buy real estate to receive cash flow or to profit from price appreciation, with passionate supporters on both sides. When we started our real estate investment journey in 2005, I was firmly on Team Cash Flow. When you buy for cash flow, you start collecting money immediately. With appreciation, you only benefit when you sell or otherwise pull out the equity (e.g., a cash-out refinance);

If you are interested in real estate, but don't know where to start and don't have network of real estate professionals to lean on, don’t worry – we didn’t either when we started.

The most important thing we did to start was to let other people know that we were looking to buy.

We didn't really know where we wanted to buy our first property when we started looking in 2001, but since it would be a weekend home, it needed to be reasonably close to New York City.

Before our first trip to Costa Rica in March 2017, we had checked out the Philippines two months earlier. Scott, our oldest daughter and I took a 2-week trip to Manila in January 2017 – their first trip and my fourth, although my previous trip was 25 years ago, so it felt like my first time too.

I was already primed to possibly live there because the favorable exchange rate (currently over 50 Philippine pesos to one US dollar) meant that we could drop everything and retire -- no job required -- right now.

In our first trip to Costa Rica, we split our week between Tamarindo (the “Gold Coast”) and Ojochal (the “Southern Zone”). These were two areas we had read about, and we wanted to compare them back-to-back.

We opted to start our Costa Rica journey with a small condo in the heart of the Gold Coast, walkable to everything. It suits our needs for a hassle-free, income-producing, and driverless vacation property. Now that we have two Gold Coast properties in our portfolio, maybe we’ll reconsider the Southern Zone. I’m afraid to look at where prices have gone even in just one year.

On our first trip to Costa Rica, while driving around the different beaches in the Guanacaste area, we stumbled on an Open House sign for a development near Playa Flamingo. We saw multiple lots, where we could develop a property, and we also saw an already built spec home we could have immediately.

It was 1,950 square feet, with 3 bedrooms and 2 baths. It had a garage and infinity pool, with a view of the ocean in the distance. It was listed at $399,000.

We ended up passing on the home, and here’s what factored into that decision.

When we decided to buy real estate abroad, one of the critical steps was figuring out where we would get the money to buy. Since we had settled on desirable Tamarindo, we knew that properties would sell relatively quickly so we would have to decide quickly and be able to close quickly (or at least show we could close quickly).

Here are eight options we considered for financing our international purchases.

I'm not exactly a football / soccer fan, but any interest I have in the sport is directed to my home team, the New York Red Bulls. Yes, technically the NYFC team in New York City (known as The New York City Football Club) would technically be my home team as the Red Bulls play in New Jersey and NYFC plays in Yankee Stadium in my home borough of the [...]

With 15 properties in our portfolio and a tendency to be risk-averse, I think a lot about how quickly and in what order we should pay off mortgage debt. We own six of our rentals free and clear – i.e., zero debt – but that leaves nine mortgages, including our primary residence. Our loans have different balances, different interest rates and different maturities. I rank ordered our mortgage debt based [...]

We bought our first multi-family property – a duplex in the trendy Riverside area of Jacksonville, Florida – and broke three investment rules in the process. We did our due diligence (e,g, property inspection, cash flow calculations) and felt that the opportunity matched our philosophy of cash flow and value over the long-term. But to get the deal done, we did have to relax some of our investment rules that [...]

Our oldest daughter is finishing up her last year of college. She got a full tuition scholarship to a city college, which saved us over $200,000 over four years vs going to a private college, an opportunity cost large enough to buy a house outright for cash! While we didn't do that, we invested that money in her future in other ways, including real estate. While we dodged the college-tuition [...]