This post is part of a series that covers key learnings we’ve had over 15 years of purchasing real estate:

- How We Got Started

- Finding Helpful Connections

- Investing For Cashflow vs Appreciation (current post)

- Turnkey Can Add Value But Is Not Completely Turn-Key

======

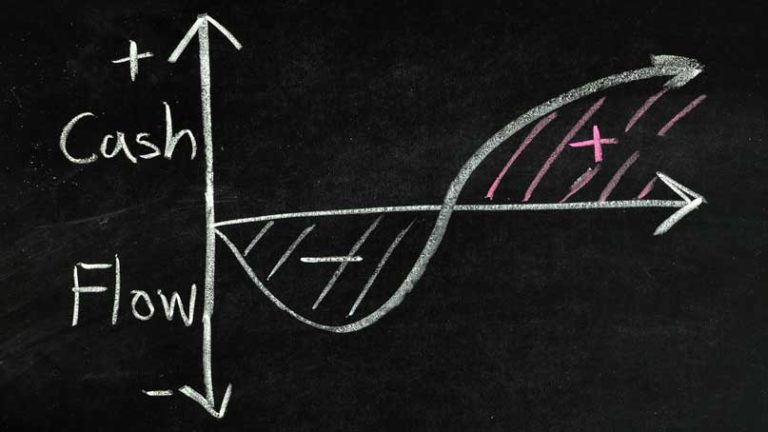

There is a long-running debate about whether to buy real estate to receive cash flow or to profit from price appreciation, with passionate supporters on both sides. When we started our real estate investment journey in 2005, I was firmly on Team Cash Flow.

The Argument For Buying For Cash Flow

- Immediate benefit: When you buy for cash flow, you start collecting money immediately. With appreciation, you only benefit when you sell or otherwise pull out the equity (e.g., a cash-out refinance);

- Numbers you can rely on: You can calculate expected cash flow pretty consistently for a real estate investment. Sure, you have to estimate how much ongoing maintenance will be with any property, but you can get a reasonable idea of these costs well in advance of purchasing. You also can easily research market rents, insurance plans, property tax rates, and even vacancy rates. With appreciation, you have to estimate what the market will be like when you’re ready to sell – this is impossible to know for sure;

- Managed risk: Buying for cash flow gives you an infinite holding time so you’ll never be forced to sell in a downturn. If you have a positive cash flow after your expenses (e.g., mortgage, insurance, taxes, maintenance, reserves for vacancy), you will always at least have your monthly rental profit. It may not be as sexy as telling a story of how you bought something that tripled in value, but you’ll sleep better at night.

The Argument For Buying For Appreciation

That said, in strongly appreciating markets, which are the most desirable markets, it’s hard to find investments that pass the cash flow test. An experienced real estate investor friend told me that when he started his investment portfolio, his early properties were slightly negative, for months and sometimes a whole year, before just breaking even.

He picked markets he believed in, but he could put very little down and not get favorable rates. The math didn’t work out in the immediate term, but because he was able to hold on long enough, eventually he got both positive cash flow and amazing appreciation. (He started buying into small apartment buildings in lower Manhattan decades ago and is now a millionaire many times over.)

Break-Even Asheville Properties Eventually Led To Costa Rica

One of our Asheville rental homes

Our first rentals were in Asheville in 2005-2007. The market was peaking, so it was hard to find purchases that would rent high enough to cover the inflated selling prices. The single-family homes we ended up buying barely covered expenses each month and sometimes went negative if there was a vacancy or unexpected repair.

Yet those two rentals have been steadily occupied, so we’ve never hit a cash crunch. While their market value dipped in the wake of the real estate bubble bursting in 2009, it has rebounded and increased enough since that we were able to refinance at a lower rate, pay off our existing mortgages, and have enough cash left over to buy our first Costa Rica condo outright. Had we stuck too rigidly to our cash flow requirement, we would have missed the chance to buy.

Cash Flow Buying Can Lead To Headaches

Buying only for cash flow also puts you in more volatile markets. Our best-performing properties from a net cash flow measurement are our Indianapolis rentals. These rentals account for over 75% of our profits. Yet, these rentals have the highest headaches by far in higher turnover, more costly maintenance, and more time and effort required to manage, even though we have external property management teams for all of our properties.

Furthermore, because these strong cash flow, albeit volatile, markets tend to be in neighborhoods of renters, not owners, there is little price appreciation to bank on. You better want that cash flow and be willing to put up with the headaches that come with collecting it because you’re not going to be able to sell for a big profit.

In our other markets, where the profit margin is so thin sometimes it feels non-existent, the headaches are also noticeably better and mostly non-existent. The price appreciation in our more expensive markets has been very strong, and while we have no desire to sell now, we know that we can – say, if we need to pay for college.

Cash Flow Vs Appreciation Verdict

So to the question of buying investment real estate for cash flow or appreciation, my answer is YES. Buy for cash flow – at least a break-even – because it protects your downside and gives you time to figure out a profit strategy, AND buy for appreciation – not speculation, but buy in a strongly appreciating, desirable market because you will probably want to pull some or all of your equity out sooner than you think.

Our Costa Rica places are both cash flow and appreciation plays. What about you? Are you Team Cash Flow or Team Appreciation?

======

This post is part of a series that covers key learnings we’ve had over 15 years of purchasing real estate:

- How We Got Started

- Finding Helpful Connections

- Investing For Cashflow vs Appreciation (current post)

- Turnkey Can Add Value But Is Not Completely Turn-Key

We are Scott and Caroline, 50-somethings who spent the first 20+ years of our adult lives in New York City, working traditional careers and raising 2 kids. We left full-time work in our mid-40’s for location-independent, part-time consulting projects and real estate investing, in order to create a more flexible and travel-centric lifestyle.

We are Scott and Caroline, 50-somethings who spent the first 20+ years of our adult lives in New York City, working traditional careers and raising 2 kids. We left full-time work in our mid-40’s for location-independent, part-time consulting projects and real estate investing, in order to create a more flexible and travel-centric lifestyle.  Financial independence and early retirement is not something we originally focused on, but over time realized it was possible. Our free report,

Financial independence and early retirement is not something we originally focused on, but over time realized it was possible. Our free report,