We are not financial advisors so nothing in this post should be construed as specific financial advice.

However, with $3 million being the new recommended retirement target, I was intrigued by a reader’s retirement plans. Stephanie, currently a US resident in her early 50’s, wrote to us with questions about Costa Rica, as she is investigating possibly retiring there and on much less than millions of dollars:

We own our home, it currently has a mortgage but we have about $130-150k in equity… I do have a small 401K with about $27k in it now, that will increase to about $50-60k by the time I retire, and we have about $12k in our checking and savings accounts.

– Stephanie

Stephanie has around $200,000 to play with ($130-150 + 50-60 + 12 = $192-222k). She’s thinking of working for another 10 years or so, investing in a Costa Rica place now to pay it off during her final working years and then retiring there where her budget can stretch further. That made me wonder: Could you retire on $200,000? If so, how would you do it?

Geo-arbitrage can stretch a retirement budget

If you only look at the $200,000 like an annuity that you have to draw down, you get $8,000 per year of income (using the 4% recommended withdrawal rate). This is hardly enough to fund a retirement, even abroad. That’s less than $700 per month, and for the Tamarindo area of Costa Rica, I would earmark several thousand per month:

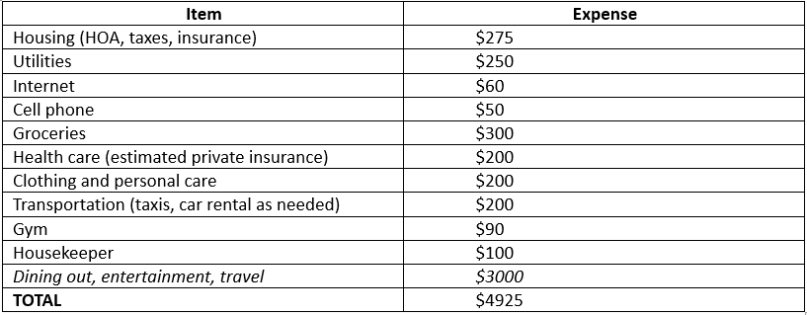

Below is a projected budget of what we would spend if Tamarindo became our primary and only residence.

The total is almost $5,000, though you could live on less. Dining out and travel are big priorities for us and make up about 60% of the total budget. Most others would likely spend less. In addition, local health insurance, which would be available to permanent residents, would be cheaper, and other expenses like clothes, gym, housecleaning, even transportation can be decreased or eliminated.

One of my favorite resources is International Living, which features profiles of expats who retire abroad off their social security income. Their estimate for Costa Rica is in the $2,000-$2,500 range — less than half of mine because their featured profiles keep to a stricter budget and are outside of Tamarindo, a known tourist town. You can save considerably, if you live further from the beach or in less populated beach towns.

For us, a permanent move to Tamarindo would still cut our US budget by more than half. Costa Rica is our FIRE Plan B, largely in part because it contains our healthcare costs. We have a barebones plan in the US that costs more than six times what we would pay for private global insurance if we simply lived outside of the US for the majority of the year.

In addition to healthcare, housing, grocery and transportation costs also decrease. The condo that we use while we’re in Tamarindo is bigger than our place in Florida, but is cheaper — 50% lower HOA dues, over 80% lower taxes and about 15% lower insurance premium. Food is cheaper – we love the weekly markets for homemade granola and food truck treats. Transportation costs would decrease considerably for us because we wouldn’t need a car full-time.

Renting would be my strategy if I had a limited amount of cash

Our housing costs in Costa Rica are low because we paid cash for our condo. Another 2-bed condo in our complex sold a few months ago in the $150’s. That’s a significant amount of money to be illiquid. Costa Rica financing is expensive and difficult to get, and I don’t know if they offer cash-out refinancing if you should ever need to pull your money out. I wouldn’t want to be forced to sell or try to sell in a hurry. While I have seen financing offers, we opted to secure financing in the US – via a cash-out refinance of other property and our self-directed retirement account.

Instead of buying a property outright and therefore tying up a significant portion of liquid assets, one might consider renting, or negotiating seller financing. Buying a property with income potential – e.g., a condo with an extra room you can rent out or a house with a standalone guest “casita” (we have one with our Casa Salita). You could then live in one room and rent the other, or live in the main house and rent out the casita for income. This could pay your seller financing or be put back into your portfolio if you paid cash up front.

Finding (or creating) a job you never want to retire from could be another way to add cash

In addition to considering whether to buy v. rent (or pay cash v. finance), I would also develop a side hustle based on something I enjoy that could add to savings pre-retirement and supplement savings post-retirement. There are many ways to make money from what you know, and if you pick something you love to do, you have created a job you never want to retire from. (We call this strategy work-as-play.)

Depending on how much extra income a fun job brings or an income property brings, that changes how quickly and how much you draw on the $200,000 in retirement savings – if at all. If you keep expenses low, invest in an income property that pays for itself and adds back to your retirement savings and take a fun job to cover daily expenses, you might not need to tap the retirement savings right away, allowing it to compound.

Here’s what I would do with $200,000 and a few years till retirement

Stephanie is early 50’s, so she has 10-20 years till social security kicks in, depending on when she decides to claim. She has a job and seems willing to work a few more years at it, which would cut the amount of time needed to bridge to social security. She could then use her social security to fund the majority of day-to-day living expenses in Costa Rica, while keeping the $200,000 as liquid reserves.

During the final years of working, I would spend the time researching Costa Rica since Costa Rica climate varies widely across the country, with some areas much wetter, some areas much hotter, some areas cool year-round which may be too cold for someone looking for seasonality. In addition to climate, some areas are more developed than others. We picked Tamarindo over Ojochal because we wanted more restaurants and services. We wanted a walkable neighborhood and easier access to/ from the airport. We also preferred the beaches in Guanacaste over the Southern Zone. That said, there’s a lot to like about the Southern Zone, and being less developed, it might prove the better financial investment.

Speaking of investing, I would look for an income property, ideally with seller financing, that can pay for itself. This would keep all of my $200,000 liquid and allow it to continue growing, rather than being spent on my own housing. A similar but alternative real estate play would be to refinance a US property, use that cash to buy in Costa Rica (this is what we did for our first Tamarindo property) and possibly rent out the US property to pay for the cash-out refinance. You’re still getting an income property that pays for itself but it’s in the US, and you live in Costa Rica mortgage-free.

Finally, while deciding where to live, whether to buy (or rent or refinance in the US to pay cash upfront), I would identify a potential fun job to take into retirement. I would start a side hustle now, which bulks up my retirement but also postpones the drawdown of my retirement money. Depending on how much it grows – and you can grow your business even in difficult times – this fun job along with social security could eliminate the need to draw down at all, ensuring a legacy or a lifestyle upgrade!

============

How would you plan for retirement with $200,000 available and several years to go?

We are Scott and Caroline, 50-somethings who spent the first 20+ years of our adult lives in New York City, working traditional careers and raising 2 kids. We left full-time work in our mid-40’s for location-independent, part-time consulting projects and real estate investing, in order to create a more flexible and travel-centric lifestyle.

We are Scott and Caroline, 50-somethings who spent the first 20+ years of our adult lives in New York City, working traditional careers and raising 2 kids. We left full-time work in our mid-40’s for location-independent, part-time consulting projects and real estate investing, in order to create a more flexible and travel-centric lifestyle.  Financial independence and early retirement is not something we originally focused on, but over time realized it was possible. Our free report,

Financial independence and early retirement is not something we originally focused on, but over time realized it was possible. Our free report,

I don’t see why not, you are a world expert and you are ideally situated to judge this. It would be tough in the US but by world net worth standards 200K is a king’s ransom. And as you know better than most, life isn’t about spending a lot of money, its about spending a lot of time doing what you love with who you love!

So true that $200k can really stretch in other parts of the world. Amazing that in the US the estimate is now $3 MM!