A few months ago, Scott and I updated our estate plans to switch from a will to revocable living trust structure, as well as update key documents to reflect that both of our kids are legal adults (i.e., age 18 and over) and that our primary residence is now Florida.

We are almost done with all the moving parts, but it will still likely be a couple of months before finishing everything. It has been an adventure and taken a lot longer than expected, so if you haven’t yet done any estate planning and you have kids or other people you want to be able to inherit your things, then you want to start now.

The below are just our adventures in estate planning. It should not be construed as legal advice!

Retitle assets, or update the beneficiary?

There are a lot of small details to chase down, so I started with an inventory (in Excel, of course) of every account and asset we own, just to see what we had to deal with. Our estate attorney wanted to make sure the beneficiary forms were updated on all accounts and assets, so every item needed at least that step.

In addition, some items needed to be retitled (changing the owner of an asset) to our living trusts. We went with a trust so that our kids could be saved the probate process, which is expensive and time consuming. But probate can only bypassed for assets or accounts that are placed into the trust – hence the retitling process. We actually created a pour-over will just in case any accounts or assets are left out of the trust (like our New York City apartment, which I’ll cover a little later).

I worked with our estate attorney on which items needed to be retitled. In general, you don’t put retirement accounts in a trust. Retirement assets have favorable tax advantages if they just pass directly to your heirs. For our 401k, IRA accounts and Scott’s company pension, we just needed to ensure the beneficiary forms were updated. So we still own the account personally and then we name specific beneficiaries in the event something happens to us. This is much easier than retitling but still means identifying each and every account and following their process for updating the beneficiary forms.

Non-retirement assets would need to go through probate so ideally they would pass to the trust or be retitled to the trust – it depends on the asset if you need an outright retitling or something else to pass the asset to the trust.

Updating beneficiary forms is not straightforward — To my descendants who survive me, per stirpes!

Apparently “To my descendants who survive me, per stirpes” is a standard beneficiary selection – I was able to select it from a dropdown menu in Vanguard (which houses our IRA accounts). The primary beneficiary for retirement assets is by default the spouse – in fact, if you want to name someone other than your spouse, you have to get the spouse to sign off on that change.

Scott and I are each other’s primary beneficiary, but we wanted our secondary to be our kids (descendants is the legalese). The “per stirpes” ensures that our kids go 50/50, and each share goes to their kids. See what I mean about details – I’m getting fatigued just recounting this, and this was probably the easiest change to make.

For non-retirement assets that didn’t need to be retitled, our beneficiaries need to be our trusts 50/50. Since we each have a trust, and they need to be equal beneficiaries, you can designate them as 50/50.

An example of an asset we didn’t retitle are our day-to-day checking and savings accounts, which stayed in our personal names. You can open a bank account in the name of your trust, but even though you and your trust share the same social security number, you don’t have the same name, and payments made to your name instead of the trust could get rejected. It sounded like the potential for unnecessary problems, so we opted to just keep our bank accounts in our names and update the beneficiary designations.

I was able to easily change the beneficiaries of our Wealthfront savings account online by following the prompts. For our main checking account, which we have with TD Bank, we had to come into a branch to make the change. I tried online and by phone, but it had to be an in-person transaction. We’re still waiting for confirmation that it has been handled, but we did put in the request.

Another work in progress is our solo 401k. We named beneficiaries when we set up the account, and like our Vanguard IRA’s, we are each other’s primary beneficiary, but as I recall, the secondary beneficiaries are simply our children – without the “per stirpes”. As our kids are pretty far away from having any “stirpes” I’m focusing on the more time-urgent tasks, but this is still an open item on my inventory.

Adding LLC’s into our estate plan

Our two LLC’s – one for real estate, one for consulting — are two more assets we had to ensure would be included in our estate plan. Including them has been the simplest process so far, but still multiple steps.

We had our small business attorney include a provision for a successor manager to be able to immediately take over the business, including the bank accounts. We named our oldest daughter because she’s business-minded and organized, and this keeps it simple. Her role as successor manager is simply to wind down operations.

Shares of each LLC were changed to be assigned to both of our trusts 50/50 (our estate attorney drafted a simple form), so we’re all set there.

Another task, although related to our move to Florida (and not the creation of our trusts), was to move our LLC’s from New York state to Florida. Unfortunately, New York does not permit you to move an LLC without dissolving it. We could have opened new LLC’s in Florida, but that would have erased the track record of our businesses. We also have a solo 401k tied to one of our LLC’s (which itself owns real estate), so we didn’t want to have to set up a whole new retirement account and roll over.

Instead, we kept our LLC’s registered in New York, but also registered them in Florida as a Foreign LLC, which means the LLC’s can do business there too. Yes, it means two annual state filings, but that’s not too expensive, and luckily our New York small business attorney already has an office in Florida, so she can continue to help us there.

Moving real estate into our trusts requires retitling each property

For real estate, we need to retitle each property in our personal names to our trusts or to an LLC.

Some of our properties are already owned within an LLC, so these do not need to be retitled, because when we assigned the shares of our LLC to our trusts, that took care of putting the real estate into the trusts.

Some of our properties are within our solo 401k, so these also don’t need to be retitled as they will pass according to the beneficiary designations we already set up with the solo 401k.

For the remaining real estate not already in an LLC or retirement account, we opted to move them into an LLC, rather than just retitling to our trusts. The LLC itself provides some additional liability protection, and the assignment of the LLC shares to our trusts was a simple process.

You can go a bit crazy with real estate LLC’s, by creating a separate LLC for each property, but we decided not to go that route – it would mean a lot of operating agreements to set up and separate bank accounts to maintain. We ended up just creating a 2nd real estate LLC. Some properties would be in the original real estate LLC and some would go in the new one. With two real estate LLC’s, the total value of the assets in each could still be protected with enough property and casualty (P&C) insurance, and umbrella liability insurance.

We recently set up the new real estate LLC. The documents were simple because our small business attorney could essentially just copy our operating agreement from our first real estate LLC (but updated for Florida since this is now our primary residence). Setting up the bank account, however, took over two weeks, as our longtime bank is running pretty limited services during the pandemic.

Once the bank account was set up, we started the process of retitling property into the new LLC via Legal Zoom. It should be pretty straightforward as it’s a Florida-based LLC, and we’re retitling Florida-based properties. When we have confirmation that the retitling is done, we would update our P&C insurer, our umbrella liability insurer and our property manager for the relevant property.

Our North Carolina property retitling was straightforward, but still more involved than I expected. Even though we used an existing LLC, it was still a multi-step process:

- get approval for the deed change with our mortgage company (some mortgage lenders do not allow you to keep your original mortgage if you change ownership, but ours specializes in investments so OK’d the change),

- file the LLC to do business in NC,

- find a lawyer in NC to represent us so that we would have a physical presence and a place to receive mail,

- re-record the deed into the name of the LLC,

- assign the LLC shares to our trusts,

- update our property manager on the change so that the leases and rental payment process could be updated to the LLC,

- update our North Carolina P&C insurance company of the deed change,

- update our umbrella insurance company of the deed change.

Two properties will not be retitled – our primary and secondary residences

A call to our county tax office nixed our plan to retitle our Florida primary residence into one of our real estate LLC’s. We would lose our homestead tax exemption if we retitled. The exemption takes off $25,000 of your tax-assessed value which can mean hundreds of dollars off your annual tax bill. The cost of probate is more than several hundred dollars, but hopefully we wouldn’t need probate (because we wouldn’t die) for years. In the meantime, we’ll take advantage of the homestead exemption. If we ever move and turn this condo back into a rental, we can retitle to an LLC at that point.

We also haven’t retitled our New York City apartment. It is what is known as a cooperative, or coop for short. It’s not a condominium where you own the actual real property. A coop is when the building is structured like a corporation, that corporation owns the building and you own shares in that corporation proportionate to the square footage of your apartment.

Coops in New York City are notorious for making it difficult to transfer your shares from your personal name to a trust or LLC. Our estate attorney has already warned us she has seen legal fees of several thousand dollars to work with coop boards to get this approved, as well as additional closing costs of several thousand dollars to transfer the shares.

Since we don’t know how long we’ll own this apartment we’re not retitling for now. If we don’t make any change, the coop apartment would have to go thru probate, which also costs thousands of dollars. I figure we’ll pay later instead of now!

Price tag so far? Over $10,000!

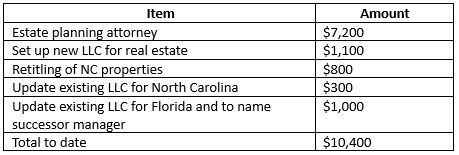

Even without the New York co-op retitling costs, we have spent over $10,000 for our updated estate plan.

We still need to retitle a couple more properties so that number will tick up several hundred dollars. The LLC’s have ongoing filing requirements but these become part of our ongoing business budget.

While this seems like a lot of money, I had interviewed several estate planning firms before sticking with our original attorney from our first plan. She wasn’t the cheapest but she wasn’t the most expensive either. She has always been responsive and reliable, and we have been happy with our support throughout this process.

We now have our trusts, a pour-over will, healthcare proxies and power of attorneys for four (our adult kids got theirs done as well). We feel like we have protected our kids and will not leave them with a mess should something happen to us. This isn’t an easy topic for some people to think about, but given the pandemic, it should be top of mind. I’m so glad I got this process started before things slowed down.

======

Did I scare you away from doing your own estate plan? I hope not, and I hope you have an easier experience of it!

We are Scott and Caroline, 50-somethings who spent the first 20+ years of our adult lives in New York City, working traditional careers and raising 2 kids. We left full-time work in our mid-40’s for location-independent, part-time consulting projects and real estate investing, in order to create a more flexible and travel-centric lifestyle.

We are Scott and Caroline, 50-somethings who spent the first 20+ years of our adult lives in New York City, working traditional careers and raising 2 kids. We left full-time work in our mid-40’s for location-independent, part-time consulting projects and real estate investing, in order to create a more flexible and travel-centric lifestyle.  Financial independence and early retirement is not something we originally focused on, but over time realized it was possible. Our free report,

Financial independence and early retirement is not something we originally focused on, but over time realized it was possible. Our free report,

Great post, how are you dealing with your Costa Rica properties?

We wrote an update end of March: https://costaricafire.com/real-estate/how-we-are-managing-our-costa-rica-real-estate-after-coronavirus/ and since borders are still closed, not much has changed. We get some local tourists, as Tamarindo is a beach destination for Costa Ricans, much like Florida is for Americans. But that’s a slower volume, of course, and beaches only reopened last month. Luckily holding costs are low, so we’re sitting tight and next high season picks up Thanksgiving onward. I expect it will lumber along till then.

Hi – I realize you were probably asking in the context of our estate planning, so adding on to Caroline’s comment. We didn’t need to do anything to the Costa Rica properties, because one is owned by our LLC, and the other two are owned by our Solo 401(k) retirement trust, and so the changes we made were to those entities.

Since you are new to Florida you may not realize you get $50K in homestead exemption, rather than $25K… they changed the law to allow an additional $25K a few years ago. I presume they have not rescinded this law and not made retroactive. My tax bill still shows the two different $25K exemptions.

Thanks for the idea of listing all your assets in a spreadsheet. When I started thinking about getting an estate plan together, the moving parts seemed overwhelming. Listing in a spreadsheet, with columns to check off as retitling or beneficiary details are addressed, seems like a great way to organize this oftentimes daunting task.

Hi Lynne, yes, I had seen mention of an additional $25k but I wasn’t sure if you had to qualify for that. I didn’t look into it — we’ll be pleasantly surprised! Regarding the estate planning, the spreadsheet was invaluable to keep track of what needed what. Many times I had to leave messages or trade emails or wait for something. I felt like I needed Salesforce or some other CRM system!