We recently moved into a condo that we had owned as a rental for 7 years. While the tenant was great (e.g., paid on time, low maintenance), the place still needs a lot of work. We also have very different tastes. I think the tenant had migraines or otherwise didn’t like light (vampire?) because the floor and walls were kept very dark.

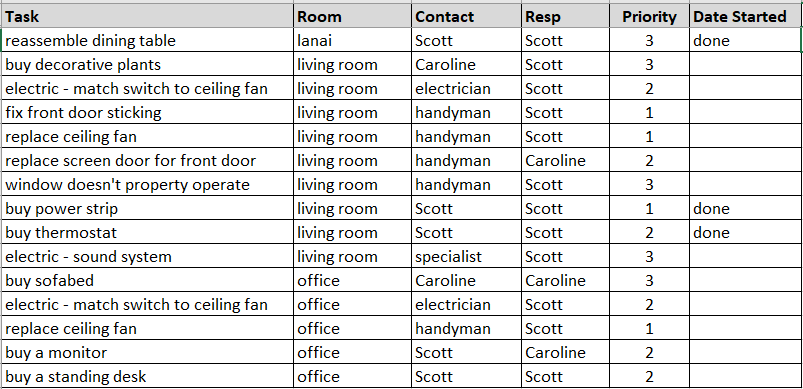

One of the first things we did upon moving was to draw a list of home renovations, updates and other projects. We came up with 78 items! Here is a snapshot of some of them:

Some of the jobs are big, like painting the whole house and renovating the sunroom. Some are small, one-off tasks that Scott will do, like replacing the lost key to the outdoor storage area, getting casters for a bed frame that rolls too much and getting quotes for optional projects we’re exploring, such as what to do with the popcorn ceiling. Still more jobs are in-between – one-off tasks but requiring a specialist. We already completed some long-needed maintenance on our AC unit and ducts, and electrical updates are next. We also replaced key appliances.

Some projects moved up in priority because we could outsource them all to one person

If we do everything on our wish list, it would cost at least $50,000, so ideally we would spread out the projects over time. We prioritized our initial list using a simple 1, 2 or 3 system, with the idea that we would do priority 1 items right now, priority 2 a few months or more later and priority 3 if we had money left over.

However, for each project or task, we also noted who would do the task, and there were several priority 2 and 3 items that a handyman could knock out. It made sense to bunch up many of the tasks and just get them done now. You get a better-quality handyman when you can give them more work.

I also want to err on the side of doing an update earlier than later, especially if I’m sure it needs to get done eventually. We are not handy people, so tended to avoid renovations. But when we bought our apartment in New York City, it absolutely needed a new kitchen. We did that right away, but held off on renovating the bathroom for three years after moving in. I wish we had renovated, and therefore enjoyed the updated version, much sooner.

When in doubt, I weigh price v. cost v. value

One of the projects that shifted from a priority 1 to 2 in our new condo was a kitchen update. The kitchen is in pretty good shape, so it doesn’t require a gut renovation. The paint and tile floor are old, and the countertops are dated. We replaced the refrigerator right away, and ideally all the appliances would match. How much is an updated kitchen worth to us?

Price-wise, we would need to spend upwards of $10,000 on the kitchen. It’s not a large kitchen, but a new microwave, stove and dishwasher will still run you $2,000. We already spent almost that much on the fridge alone. Then there are the countertops (I like quartz) which would need to be custom-sized to the space. Finally, the labor costs for countertop installation, painting and tiling add up. In our last kitchen renovation, labor was half of the total invoice.

The cost of the renovation, however, is not just the price. There is the time – we’d lose the use of our kitchen for several days and would spend more on dining out than typical. There is also the hassle factor – we have a working kitchen now, and I like home-cooked meals. Finally, there is the opportunity cost of earmarking $10k now for a working, albeit dated kitchen, instead of other projects or other things altogether, like saving the money or checking off another destination in our 100 Dreams of Travel.

What is the value of an updated kitchen? Arguably it’s high, given how much we’re home and how much a kitchen contributes to maintaining home value.

I use the price/ cost/ value framework even for small purchase decisions

Scott wants to get a Roomba because we have no carpets, just LVP flooring, and it easily gets dusty and sandy, especially given how much we go to the beach. We already have a vacuum, and left unchecked, I think Scott would default to having gadgets for everything!

The price of a Roomba is under $300 for a basic model, which isn’t an inordinate amount of money. (Even I am intrigued by the Roomba, and this seems like a small price to pay to quell a curiosity).

However, a friend of mine who owns multiple Roombas (he has a very large, multistory house and also uses Roombas dipped in paint for art projects!) warned me that the Roomba is loud. He says he leaves the house when it’s running, though Life on AI shows the Roomba is comparable to a washing machine or dishwasher. The cost to our ears is worth considering. If you look at the opportunity cost, we could buy a hand vac for a fraction of the price and have money left over to chip away at the other 78 items on our wish list.

Value-wise, I know Scott would get a lot of entertainment value from the Roomba. It’s probably a net negative to me since I don’t like learning new tech, and I already know how our vacuum works. I’m also not convinced it would really clean. So far it’s a No on getting the Roomba.

On the flip side, we just spent over $1,000 on a new mattress. We have a Tempur-Pedic in NY that we just love, but it was a lot more than $1,000, and I haven’t been able to pull that trigger again. Still the value to us of a quality mattress is very high — Scott and I both love to sleep! In addition, the cost of a bad decision here is also significant, since sleep is such an important health factor. While the price point of this purchase is higher than the Roomba, the cost and value arguments point to Yes.

Paint, flooring and the sunroom are the priority 1 big projects

We replaced the floors before we moved in, and we will definitely repaint and renovate the sunroom. However, we’re holding off on updates to the kitchen and bathrooms and holding the line on additional furniture. We are not avid sharers on social media, where some post their before and after renovation pictures. But we’ll keep you updated in a future blog post when we are done!

We are Scott and Caroline, 50-somethings who spent the first 20+ years of our adult lives in New York City, working traditional careers and raising 2 kids. We left full-time work in our mid-40’s for location-independent, part-time consulting projects and real estate investing, in order to create a more flexible and travel-centric lifestyle.

We are Scott and Caroline, 50-somethings who spent the first 20+ years of our adult lives in New York City, working traditional careers and raising 2 kids. We left full-time work in our mid-40’s for location-independent, part-time consulting projects and real estate investing, in order to create a more flexible and travel-centric lifestyle.  Financial independence and early retirement is not something we originally focused on, but over time realized it was possible. Our free report,

Financial independence and early retirement is not something we originally focused on, but over time realized it was possible. Our free report,