A recent Twitter conversation reminded us about how we often refer to our rental properties birthing babies, when we tap the equity in them to buy more houses. We used a cash-out refinance of our two North Carolina rentals to buy our condo in Costa Rica. Essentially, our Asheville places birthed Condo Boom.

You can also access your property’s equity with a home equity line of credit. We used a HELOC on our first property in New Jersey to buy our first investment property in North Carolina — the first rental baby!

That Twitter conversation was about someone looking to understand the reasons why people have given up and sold their rental properties, and the response about our rental properties birthing babies was given as a reason why we have not given up on real estate. In fact, real estate birthing babies is just 1 of 10 reasons why we continue to love real estate.

There are 4 commonly cited ways that rental real estate makes you money

As mentioned, having one property lead to more property is just 1 of 10 reasons we love real estate and why a majority of our portfolio is real estate investments (currently 55/45 real estate to paper). Most money posts don’t focus on rental babies when advocating for Team Real Estate. After all, rental babies only matter if you want more than one property, and you have to have enough equity in the first property to birth the second.

However, even 1 rental can make you money with:

- Cash flow

- Appreciation

- Depreciation tax benefits

- Principal pay-down

Cash flow (reason 2) comes from rents exceeding expenses, so you have to buy a property with good rental potential and manage it well enough (or hire a good property manager) such that expenses are kept in line.

Appreciation (reason 3) has been estimated at 3-5% annual average in the US, but of course it will vary by location. It will also vary depending on how the economy is doing (16.2% year-over-year growth comparing August 2020 to 2021!). When we sold one of our Florida condos just this past July, we got 30% more than what we would have sold for two years prior!

Real estate depreciates, and you can write off the depreciation (reason 4) amount against your other income, thereby saving you on taxes. Check with your accountant, but you can see a general explanation here.

Principal pay-down (reason 5) is a benefit only if you have a mortgage, and your rent covers the mortgage payment. I highlight it because many people do have mortgages on their properties, and this benefit is almost invisible if you don’t call it out. You make the mortgage payment every month, and while the renter pays you back with monthly rent, you don’t see the principal pay-down hitting your account. But it’s noticeable once you sell!

Real estate also saves us money

The HELOCs we have on our rental properties are cheaper credit (reason 6) than other types of loans, like business loans, personal lines of credit or credit cards. If you’re not a disciplined spender, this could be a recipe for disaster, but we have made good use of our HELOCs. When they’re not birthing rental babies, they are smoothing out big expenses, such as when I started my career coaching business in 2008 – when income was lumpy and expenses came in regularly. Even 14 years into my business, a loan on my business would cost more than tapping a HELOC on our rental.

Bleisure travel (reason 7) is another way that rentals save us money, even as we spend. We buy rental real estate in places where we love to visit. When we check on our rentals, that’s a business expense and therefore a tax savings (again, check with your accountant), but we still enjoy ourselves when we’re there.

Having to come up with the down payment, amass reserves for maintenance and other expenses, and make those monthly payments when the property isn’t occupied all costs money. But we’re happy to do it because we enjoy scouting for real estate, running the numbers and overseeing our growing portfolio. These forced savings (reason 8) are certainly a higher level of savings than we would do on our own without the motivation of building a real estate empire encouraging us on.

Real estate protects us from inflation (and from ourselves)

Rents go up when inflation goes up, which makes rental real estate a nice inflation hedge (reason 9). As expenses increase, you don’t always know your salary will keep pace. Having worked in HR for 20+ years, I have seen many companies pause raises or even cut back salaries during tough times. But when tenants see other expenses rising, they expect and accept their rent to rise as well, and that’s an income boost if you’re on the landlord side.

Finally, when I feel like shopping, I scout listings instead. Window shopping becomes research (reason 10)! I satisfy my shopping craving and learn something at the same time.

Summary of the 10 reasons why we love real estate:

- Rental babies

- Cash flow

- Appreciation

- Tax benefits

- Principal pay-down

- Access to cheaper credit

- Bleisure travel

- Forced savings

- Inflation hedge

- Shopping for good

Do you have other reasons (logical or emotional) for loving real estate?

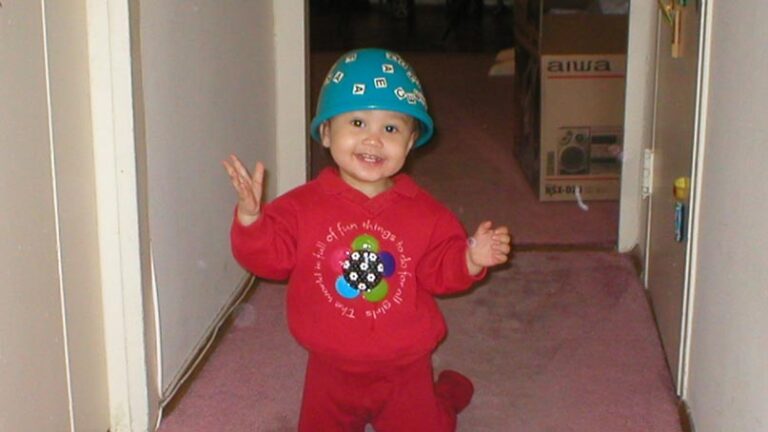

Note: the photo at the top is one of our babies, now a 20 year old college junior!

We are Scott and Caroline, 50-somethings who spent the first 20+ years of our adult lives in New York City, working traditional careers and raising 2 kids. We left full-time work in our mid-40’s for location-independent, part-time consulting projects and real estate investing, in order to create a more flexible and travel-centric lifestyle.

We are Scott and Caroline, 50-somethings who spent the first 20+ years of our adult lives in New York City, working traditional careers and raising 2 kids. We left full-time work in our mid-40’s for location-independent, part-time consulting projects and real estate investing, in order to create a more flexible and travel-centric lifestyle.  Financial independence and early retirement is not something we originally focused on, but over time realized it was possible. Our free report,

Financial independence and early retirement is not something we originally focused on, but over time realized it was possible. Our free report,

The article I needed to read to affirm that rental RE is still a viable way to wealth. With the market as it is today and no shortage of opinions, it’s nice to hear how you both have leveraged the NC properties to create a life of long term wealth. I’ve always wondered how much of an interruption it is to be a hands-on landlord, but you guys are doing it right!

Thanks Gary! We have property managers for all of our properties. Though you still have to manage the managers and make the ultimate decisions on big expenditures, it definitely helps to have strong support, and we highly recommend it. Otherwise, real estate becomes more of a job than an income stream.