This reader is thinking of making a real estate investment in Costa Rica but is also considering options closer to home:

I LOVE what you guys are doing! I stumbled across your blog a couple weeks back and have been reading various articles that you’ve published. You two are my heroes!

My wife and I are in a similar situation to you (although we met and had kids a bit later than you). We are a family of four with both my wife and myself in our mid 40’s. Our oldest is starting high school next year and our youngest will be in 7th grade. I’ve recently been looking into real estate as our FIRE plan.

Our problem is we can’t settle on where to start. We initially thought maybe a B&B near our home in Austin, TX…. a bustling community that’s becoming very well known for their wedding venues and craft breweries and distilleries, and this seems like a great area to invest in. However, we’re concerned about the level of physical effort as well as financial commitment required.

So we started looking at condos on the Texas coast. We can pay cash for a 2b/2ba condo. It’s close enough (3.5 hours) to make a trip should we need to.

Then we started looking at Costa Rica (how I found your blog). We vacationed to Costa Rica a couple year back and loved it. We eventually want to own a vacation home in Costa Rica. Just based upon internet research it looks like we may be able to purchase a condo in cash in Costa Rica. However, given our lack of real estate experience we’re hesitant to start our journey in a foreign country.

Our long term goal is to own 3-4 vacation homes and rotate between them while they produce income when we’re not in them. Ideally we’d own homes in Austin, Costa Rica, and Europe.

For first time real estate investors looking to start our FIRE journey what advice can you provide? The condo on the Texas coast seems like the safe place to start, but really feeling drawn to Costa Rica since we’d eventually like to own a home there anyway.

Peace and blessings,

Jeff

There Is No One Right Answer In Real Estate

My first reaction to Jeff’s question (aside from my effusive gratitude at his kind words on the blog – thanks Jeff!) was, “Wow, you can’t go wrong with homes in Austin, Costa Rica and Europe, in whatever order you purchase them!” Seriously, there is no one right answer in real estate, including the question of what to invest in first.

Investing closer to home has its advantages. You likely know the area better. You potentially self-manage your investment. Even if you outsource day-to-day management, you can get to your property more quickly when you need to and check in more frequently.

That said, sometimes the numbers don’t work to invest close to home, as was the case with us in New York City. Austin is a hot market, so purchase prices might be too high to support the rental income you could get. In crowded markets, bidding wars might cut into the time you need for proper due diligence. If your future plans might include a move, investing close to your current home only conveys a short-term advantage.

The decision of local v. remote is even more complicated in this case because an international investment (Costa Rica or Europe) is up for consideration.

We outlined in a recent post the downside of an international property as a first real estate investment. In this case, Jeff and his wife are ahead of us on the numbers side — they have cash and don’t have to worry about financing (we financed our first investment). However, the emotional anxiety of being so far away from your first purchase and having to navigate the additional layers of another country’s legal and financial regulations still apply.

Real Estate Is A Financial And Emotional Decision

Whatever the numbers say, there will be an emotional component to the decision.

On the numbers side, we considered:

- Purchase price

- Rents and rentability

- Capital appreciation (we buy for cash flow mainly, but appreciation factors into timing)

- Financing costs, including closing costs

- Maintenance and other ongoing expenses like utilities

- Capital expenses, including upfront renovation needs

- Insurance (both premium costs and insurability – we own property in Florida!)

- Taxes

- Management team, including costs and quality

- Risk factors (e.g., stability of the area, impact on our portfolio, exit strategy)

Some of these factors may have additional underlying issues to research and consider. Many of these factors will be estimates so we stress-tested these (e.g., what if vacancy is higher than we expected?) to see how much margin we had if we were wrong.

On the emotional side, we considered:

- How comfortable we felt making this investment – with any investment, and real estate is no different, things can go wrong

- How willing we would be to put time and effort into this – real estate is never 100% passive

- Whether there was something else we wanted to do more

- How comfortable we felt with the management team, since we would not be managing any of our real estate ourselves

Most of the due diligence was on the numbers side, but the emotional side was definitely a factor.

Focus On Your Decision Process Over Any Specific Decision

I am not a financial advisor and cannot legally make specific recommendations. Besides, I wouldn’t make any specific recommendation on a large, long-term investment like real estate for anyone whose financial picture I didn’t know inside and out (which basically means I’m only making real estate calls for my own household, not even friends and family!).

However, I will say that if you’re stuck, it’s helpful to focus on your decision process instead of the specific decision.

By decision process, I mean what factors are you specifically looking at? How do you prioritize the factors relative to each other? Since you are deciding as a couple, how will you weigh each other’s concerns and preferences?

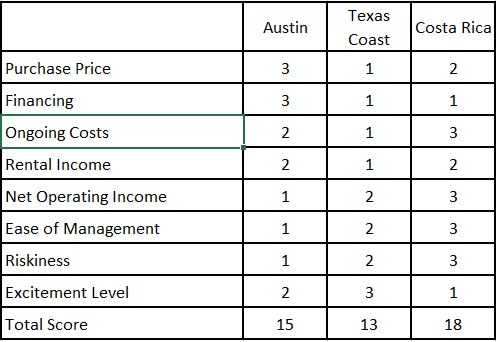

Consider A Decision Matrix To Visualize And Compare Your Options

I find it helpful to assign a point system to the different factors and then compare scores across the various options. List out your decision factors and rank each real estate option according to that factor. For example (I’m just guessing on the rankings here to give you an idea):

In the above matrix, I gave the best option a 1 and the worst a 3. So the lower the points, the better the option. For purchase price, I just guessed that Texas Coast would be cheaper than Costa Rica which would be cheaper than Austin, hence the respective rankings.

The above makes Texas Coast look like the best deal, but of course, I’m just using nonsensical numbers. The numbers are not why the matrix is useful. Whichever property comes out on top, you can look at your factors and how you measured them and see visually how that aligns with your expectations:

- Did you include all the factors that matter to you?

- Do some factors matter more than others? If so, you may want to weigh those factors 2:1 and make them more impactful to the final score.

- Is your decision matrix very different from your spouse? If so, you have a launching pad for comparing results in an objective and productive way.

A thoughtful decision process, like using a matrix, makes a big, amorphous decision more tangible. It can help you keep track of your options and the tradeoffs you are making. You can update the matrix when you get new information. You can reuse the matrix for subsequent decisions.

======

How about other readers who have already purchased real estate? How did you pick your first property?

We are Scott and Caroline, 50-somethings who spent the first 20+ years of our adult lives in New York City, working traditional careers and raising 2 kids. We left full-time work in our mid-40’s for location-independent, part-time consulting projects and real estate investing, in order to create a more flexible and travel-centric lifestyle.

We are Scott and Caroline, 50-somethings who spent the first 20+ years of our adult lives in New York City, working traditional careers and raising 2 kids. We left full-time work in our mid-40’s for location-independent, part-time consulting projects and real estate investing, in order to create a more flexible and travel-centric lifestyle.  Financial independence and early retirement is not something we originally focused on, but over time realized it was possible. Our free report,

Financial independence and early retirement is not something we originally focused on, but over time realized it was possible. Our free report,

I haven’t invested in real estate myself (unless you count a rooming house in my 20s that I sold a couple of years later for a variety of factors — though I *did* at least make a good profit), so take my advice with a grain of salt. But my inclination would definitely be to purchase closer to home. Once they’re more comfortable with real estate investing, then they can move to home abroad. A condo just a few hours away seems like a good place to start. Just my two cents.

Thanks for your input Abigail!

The nice thing about the decision matrix is that since there are many factors to consider, you can use it to weigh all the options and apply more weight to individual items that are more important to you, such as location.

And congrats on coming out of that first real estate investment in the green!

Thank you for this helpful tip. I have invested in one condo here and it was my first real estate investment. I’m due to pay off the mortgage two years from now (can’t wait!!!) and I’m thinking of getting another one so I could also rent it out. I’m glad to have stumbled upon your decision matrix and I find it really useful.

I’m glad you found the decision matrix helpful! Congrats on almost paying off your first rental and potentially expanding your portfolio. We have found that owning multiple properties helps smooth out earnings when there is a vacancy or maintenance issue in one of them. Of course, that presumes that all of them cash flow and contribute to reserves over time.